"Buffett's Bailout: Analyzing Warren Buffet's investment in Goldman Sachs during the 2008 financial crises

The day before yesterday I discovered the deal between two giants in the investing world “ Mr. Warren Buffet and Goldman Sachs” and the fact that this deal was made in the year 2008 itself, the year of the great global financial crisis. As someone who admires Warren’s approach to investing and finance as a whole, the mere thought of not knowing about such a significant collaboration between two giants of the finance field kept me up at night.

Warren Buffett’s investing in Goldman Sachs during the 2008 financial crisis isn't just about being smart with money. It's also about planning and handling tough times. Let's explore this deal, see how it changed finance, and learn important lessons for investors like us."

The Berkshire Hathaway Deal

The financial crisis of 2008 was a turbulent-ish time for the global financial markets marked by the collapse of several major financial institutions and a major cash and credit crunch. Major banks and financial institutions were on the verge of failure after Laymen Brothers caused financial havoc all around the globe as institutions were facing a shortage of capital due to massive losses and the freezing of credit markets.

Goldman Sachs despite being considered one of the most stable banking institutions was not immune to the crisis as well. Goldman Sachs was facing a major credit crunch as the effect of crises kept on escalating causing a loss of trust from the investors.

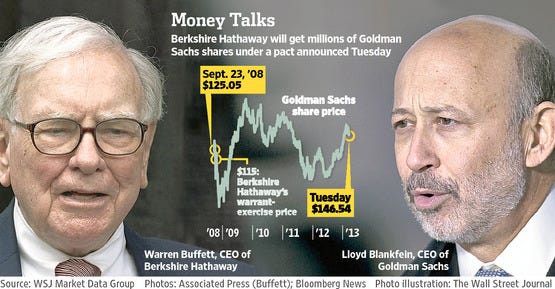

In September 2008, as the financial crisis was intensifying, Warren Buffett's Berkshire Hathaway made a significant $5 billion investment in Goldman Sachs. This investment was structured as preferred stock, entitling Berkshire Hathaway to a fixed dividend of 10% on the investment. Preferred stockholders, like Berkshire Hathaway in this case, have a higher claim on assets and earnings compared to common stockholders, making this investment a favorable arrangement.

Additionally, Berkshire Hathaway was granted the option to purchase an additional $5 billion of common stock in Goldman Sachs for $115 per share. This option provided Berkshire Hathaway with the opportunity to further profit if Goldman Sachs recovered from the crisis and its stock price increased.

The terms of the deal were advantageous for Berkshire Hathaway, providing a steady income stream through the 10% dividend on preferred stock and the potential for further profit through the option to purchase additional common stock at a discounted price. This strategic investment not only helped bolster Goldman Sachs' financial position during a challenging time but also showcased Warren Buffett's shrewd investment understanding and belief in the bank’s long-term prospects.

Buffett's deal versus Paulson's

Paulson's Role: Paulson led efforts to implement the Troubled Asset Relief Program (TARP), aimed at stabilizing financial institutions and markets by purchasing troubled assets. He also worked to restore confidence in the banking sector and prevent further economic downturn.

Buffett's Investment: In contrast, Buffett's investment was a targeted move to provide capital specifically to Goldman Sachs. While it helped stabilize the bank, it was not part of a broader systemic rescue effort like Paulson's.

Impact: Paulson's actions were aimed at preventing a broader financial collapse, while Buffett's investment was focused on a specific institution. Both were important in addressing the crisis from different angles.

Paulson's approach was aimed at stabilizing the entire financial system, while Buffett's investment was a targeted move to provide capital specifically to Goldman Sachs. Both were important in addressing the crisis from different angles.

If you would like more detailed information, please refer to The New York 2008 article, linked below.

Impact and Aftermath of the Deal

Warren Buffett's $5 billion investment in Goldman Sachs during the 2008 financial crisis had a profound impact, stabilizing the bank and instilling confidence in the markets. His vote of confidence in Goldman Sachs' resilience helped restore faith among investors, preventing a deeper decline in the bank's stock price. Buffett's reputation as a wise investor also played a significant role, reassuring stakeholders and signaling that Goldman Sachs was a sound investment despite the turbulent times. This strategic move not only provided crucial liquidity to the bank but also showcased Buffett's belief in the long-term value of strong, well-managed institutions.

Click the below link to learn more about the impact of the deal.

Detailed coverage by the New York Times.

Criticism and Controversy

Despite the deal ending up being favorable to both parties still it faces lots of backlash, criticism, and whatnot. I’ll try to make you understand in layman’s language

Favorable Terms Gone Friendzone

Imagine you see your super successful friend score an amazing deal on a new car – like, way cheaper than anyone else. You might wonder, "Did they get that sweet discount because they're, you know, them? Maybe the salesperson recognized them?" That's kind of what some folks felt about Buffett's high 10% dividend. They thought he got special treatment because of his reputation.

Conflict of Interest? More Like Shady Backroom Deals

Now, imagine your friend who got the car deal also happens to work at the car dealership. Suddenly, that discount seems a bit suspicious, right? Maybe they'll get preferential service or sneak in some extras you wouldn't get. That's the concern some had with Buffett's investment. People worried his stake in Goldman Sachs might influence the company to favor Berkshire Hathaway in its business dealings.

Transparency? More Like Seeing Through a Foggy Window

To top it all off, the whole deal with Buffett's investment felt a bit secretive. It was like trying to see what was happening in a business meeting through a fogged-up window. Critics argued that without knowing all the details, it was impossible to tell if the deal was truly fair for everyone involved.

In summary, Warren Buffett's investment in Goldman Sachs during the 2008 financial crisis was a smart move that showed his ability to make strategic decisions during tough times. Despite some people criticizing the deal, it helped stabilize Goldman Sachs and restore confidence in the financial world. Buffett's investment reminds us of the importance of confidence and smart planning during crises. Looking back at this moment in financial history, we can learn valuable lessons in how to manage tough situations and make wise investment choices, all from one of the most successful investors of our time.

Thank you for reading patiently, fucking tired and can’t write a word more :(

signing off,

Prajwal Shukla

Good Article bro!